Can You Fold Form 1096 When Mailing

On each package write your name number of packages consecutively and place Form 1096 in. Put your 1099 and 1096 -- and any other tax documents being submitted at the same time -- in a flat mailing envelope.

Official 1099 Forms At Lower Prices Zbpforms Com

Non-profits list which forms are being mailed to the IRS using Form 1096.

. On each package write your name number of packages consecutively and place Form 1096 in the first package. Can you fold 1096 form to mail. Youll only need to separate them if youre sending multiple EINs.

Mail your tax return first-class. Can you handwrite a 1096. The 1099 Tax Forms will need to be submitted to the IRS in a flat mailing envelopenot folded.

Make sure to order scannable Forms 1096 for filing with the IRS. Kansas City MO 64121-9256. We recommend you file Form 1099-MISC as a stand-alone shipment by January 31 2019 if you are reporting nonemployee compensation NEC in box 7 which I am.

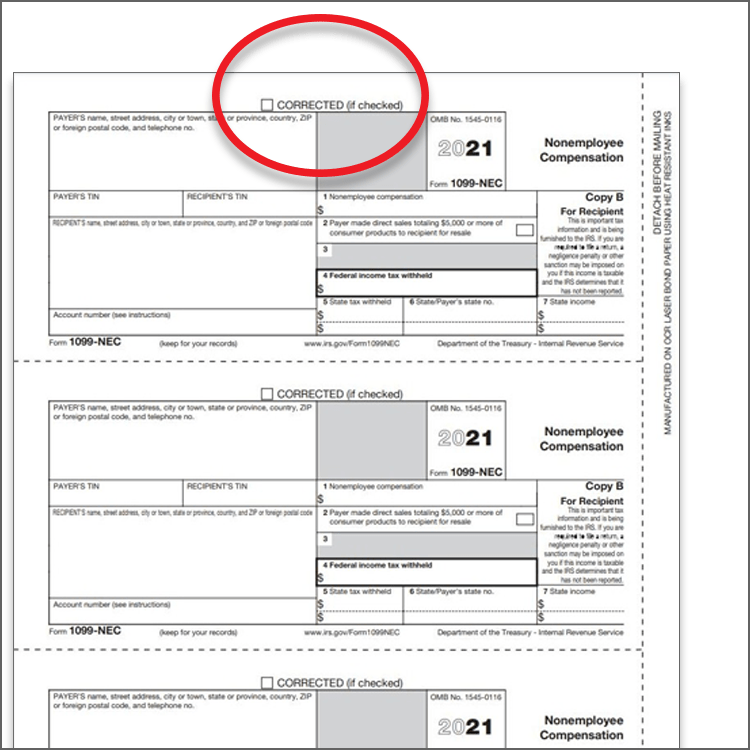

The new one should be accompanied by an 1099s that you are changing - whether up or down in amount. The 1099 Tax Forms will need to be submitted to the IRS in a flat mailing envelopenot folded. You send in a new one and mark the box that says CORRECTED.

Printing a PDF of the form from the IRS website will result in a document that cannot be scanned by the IRS. Form 1099 is used to claim a variety of deductions or payments to organizations and individuals. In order for the IRS to process Form 1096 you must submit a scannable version of the document which you have to order from the IRS ahead of time.

The 1099 Tax Forms will need to be submitted to the IRS in a flat mailing envelope not folded. 1099 and W2 envelopes are used for sending 1099 and W2 tax forms by mail but between size window placement and the type of form you have. The 1099 Tax Forms will need to be submitted to the IRS in a flat mailing envelope not folded.

The 1099 Tax Forms will need to be submitted to the IRS in a flat mailing envelopenot folded. Department of the Treasury Internal Revenue Service Center Austin TX 73301. How to mail 1099-MISC.

For 1096 and 1099 forms you correct instead of amend. Here is the IRS Form 1096 Instructions. You must mail or hand Form 1099MISC Copy B and Form 1099MISC Copy 2 to each independent contractorpartnershipLLC by January 31st.

California Connecticut District of Columbia Louisiana Maryland Pennsylvania Rhode Island West Virginia. File one Form 1096 Annual Summary and Transmittal of US Information Returns for each different type of your 1099 filed. Where To File Send all information returns filed on paper with Form 1096 to the following.

Can you fold 1096 form to mail. Department of the Treasury. If submitting a large number of documents you may mail them in multiple envelopes but you must make sure to number the envelopes.

If sending many forms you can send them in a conveniently sized package. Anyone with experience on mailing 10991096 forms for multiple clients all in same envelope to IRS know if we need to include any sort of transmittal sheet. You must mail Form 1096 and the accompany 1099MISC Copy A forms the 1096 and 1099 Copy A.

This document must be filed with the government if the organization is mailing Form 1098 1099 3921 3922 5498 or W-2G along with the completed form. Information Returns including recent updates related forms and instructions on how to file. 1099 and W2 Envelopes.

The 1099 Tax Forms will need to be submitted to the IRS in a flat mailing envelopenot folded. For more details about 10991096 filing and FAQs check out these guides below. On each package write your name number of packages consecutively and place Form 1096 in the first package.

Or can we just paper clip 1096 form on top of 1099s it belongs to and mail multiple in same envelope. On each package write your name number of packages consecutively and place Form 1096 in the first package. If sending many forms you can send them in a conveniently sized package.

The benefit of E-filing is that you do not need to mail any documents or even file a 1096. Submitting one of those to the IRS could result in a penalty. Instructions for Form 1096 PDF.

QuickBooks Desktop setup troubleshooting FAQs. On each package write your name number of packages consecutively and place Form 1096 in the first package. Can you fold 1096 to send to IRS.

The 1099 Tax Forms will need to be submitted to the IRS in a flat mailing envelope not folded. Do not fold the forms in any way. The General Instructions for Certain Information Returns say.

Post office regulation requires that package and forms be sent by First-Class Mail. When sending important documents by mail such as tax information security envelopes must be used to maintain the secrecy of the recipient. The benefit of E-filing is that you do not need to mail any documents or even file a 1096.

If sending many forms you can send them in a conveniently sized package. If sending many forms you can send them in a conveniently sized package. Information about Form 1096 Annual Summary and Transmittal of US.

Form 1096 - Internal Revenue Service. Can I mail multiple 1096 in the same envelope. All About Tax Form Mailing.

Im also attaching this link to help you along the way. If sending many forms you can send them in a conveniently sized package. 2 Include all pages of Copy A with Form 1096 do not staple sign Form 1096 and mail to.

You do not need to do another one just because the first one was folded. Do not fold the 1096 or 1099 forms mailed to the IRS. For electronic filing you do not need to send in a Form 1096 nor should you send in the originally filed forms with the correction to the IRS.

Form 1096 is used by filers of paper Forms 1099 1098 5498 and W-2G to. Internal Revenue Service Center. Yes you can mail them in one envelope.

The next part of the process is to send the completed forms. Then submit the corrected IRS forms and cover letter by mail or e-file. Can you fold 1096 form to mail.

Form 1096 must accompany all paper submissions But the instructions for Form 1096 say. Can you fold Form 1096 when mailing.

A Comprehensive Guide On Form 1099 Nec For The Tax Year 2020 2021

Landscaping Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

Where Do I Mail Form 56 In The Irs Quora

Official 1099 Forms At Lower Prices Zbpforms Com

Amazon Com Adams 1099 Nec Forms 2021 Tax Kit For 12 Recipients 5 Part Laser 1099 Forms 3 1096 Self Seal Envelopes Tax Forms Helper Online Txa12521 Nec Office Products

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

Additional Tax Forms Office Depot Officemax

1099nec Forms For Non Employee Compensation Zbpforms Com

Advisorselect Form W2 1099 2015 Year End Services May Be Classified Under Common Law Rules

Is It Ok To Fold My Tax Return When I Send It In The Mail Youtube

Internal Revenue Bulletin 2017 26 Internal Revenue Service

Advisorselect Form W2 1099 2015 Year End Services May Be Classified Under Common Law Rules

Tops Top2202 1096 Tax Form 10 Pack White Walmart Com

Internal Revenue Bulletin 2021 26 Internal Revenue Service

Internal Revenue Bulletin 2021 26 Internal Revenue Service

Comments

Post a Comment